Work from Home Tax Relief in the UK: 2026 Guide to Claiming Eligible Expenses

Working from home has become a normal part of life for many UK employees. If you’re a UK taxpayer who works from home, even part of the week, you may be able to claim tax relief on certain expenses. This means you can get back some of the tax you’ve paid to cover the additional costs of running a workspace at home. In the wake of the pandemic, millions claimed this relief, but the rules have since tightened. This 2026 guide explains work from home tax relief in the UK, highlighting the post-pandemic changes and what you need to know to claim in 2025–2026 and beyond.

Remote work tax relief is not automatic – you have to meet eligibility criteria and actively claim it. The good news is that if you qualify, it’s a straightforward process that can put a bit of money back in your pocket. Below, we’ll cover which expenses are eligible (and which aren’t), who can claim, how to claim from HM Revenue & Customs (HMRC), and important tips (with examples) to make sure you claim correctly and get the relief you’re entitled to.

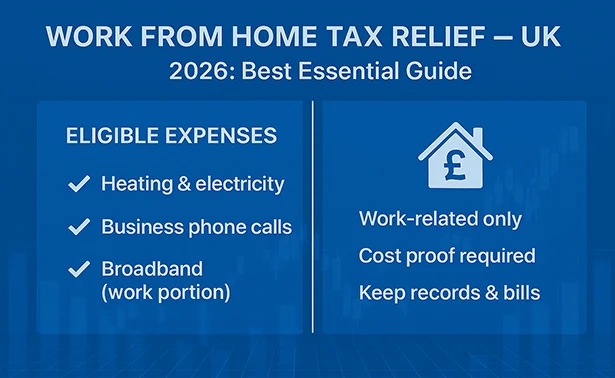

What Expenses Are Eligible for Tax Relief?

When you work from home, you may incur extra household costs. HMRC allows employees to claim tax relief on certain work-related expenses that are necessary for your job and only incurred because you work from home.

Eligible expenses typically include:

-

Heating and electricity for your work area:

The increase in your gas and electric bills from running heating, cooling, or lighting in the space you use as an office. For example, the additional power to heat your home office during working hours can qualify. -

Business phone calls:

The cost of work-related calls on your home phone or mobile, if you pay for these calls yourself. Only the expenses for calls made for your job (not personal calls) are eligible. -

Broadband or internet costs (work portion):

If you needed a broadband connection specifically for your job, or if you can demonstrate a clear work-related portion of your internet use, you can claim that portion. In practice, this usually applies only if you incurred extra costs solely due to work (for instance, an upgrade to a higher package required for work video calls).

Most employees find it simplest to use HMRC’s flat rate allowance for home working expenses. This flat rate is £6 per week. You can claim £6/week without having to calculate your exact additional bills or submit receipts. This £6/week is meant to cover the typical increased costs of energy, phone, and other small expenses from working at home. If you opt for the flat rate, you don’t need to detail each expense – HMRC accepts £6 per week as a reasonable estimate of the extra household costs due to home working.

Claiming actual costs:

If your work-related home expenses are higher than £6 per week, you have the option to claim the exact amount you’ve spent instead. To do this, you would calculate the portion of your bills that relates to your work use (for example, the increased part of your electricity bill from running a computer and heating during work hours). You’ll need evidence (receipts, bills, calculations) to support any claim above the flat rate. This method can be worthwhile if, say, you have very high heating costs in a home office during winter. However, it requires more record-keeping, and HMRC may scrutinise the claim to ensure the costs were wholly, exclusively and necessarily for your job.

Contact Our Team

To speak with our team:

📞 +44 20 7071 8676

📧 office@seperaaccounting.co.uk

Our accountants are ready to assist all clients who want a smooth transition into the new digital tax era.

What Expenses Are Not Eligible?

It’s equally important to know what you cannot claim under the work-from-home tax relief. HMRC will reject claims for expenses that are not exclusively work-related or that would be paid regardless of home working.

Ineligible expenses include:

-

Rent or Mortgage Payments:

You cannot claim a portion of your rent or mortgage interest as work-from-home expenses. Even though your housing costs are substantial, HMRC doesn’t allow relief on costs that serve a dual purpose (housing you) beyond work. -

Council Tax, Water, or General Home Bills:

Similarly, council tax and other general utilities that don’t increase due to work (or whose use is mixed personal/work) aren’t claimable. The relief is only for the additional cost from working at home, not for your normal home expenses. -

Broadband or Internet (if used for personal use too):

If you already have a home internet connection that you also use personally, you cannot claim tax relief on it. For example, you cannot simply claim your full monthly broadband bill as an expense because you also use that internet for personal browsing, streaming, etc. Only extra costs incurred solely for work (such as a second phone line or a truly work-dedicated broadband line) would be considered. -

Home Office Equipment & Furniture:

The cost of desks, chairs, computers, or other equipment is not claimable through this employee tax relief. Typically, if your employer requires you to have certain equipment, they should either provide it or reimburse you. There are separate rules for employer-provided equipment. If you personally buy equipment you need for work and aren’t reimbursed, that might fall under capital allowances or a different scheme, but it’s not covered by the £6/week homeworking relief. So, items like office chairs, printers, or laptops are not claimed here (and certainly not general home furniture or décor). -

Food and Drink:

You can’t claim your lunch, coffee, or snacks just because you’re working at home. Meals and refreshments are personal living costs, not allowable expenses for tax purposes when you work from home. -

General household maintenance or wear-and-tear:

For instance, if working at home leads you to redecorate or causes more cleaning, these costs aren’t covered by this relief. (In contrast, a self-employed person might claim a proportion of such costs in their accounts, but an employee cannot under HMRC rules for employees).

Finally, voluntary or convenience-based costs are not eligible. If you choose to work from home, any expenses you incur are deemed voluntary personal costs and can’t be claimed. We’ll cover this more in the next section, but essentially, the tax relief is meant for situations where working at home is a requirement, not a personal preference.

Who Can Claim the Work-from-Home Tax Relief?

Eligibility is key. Not everyone who occasionally works at home can claim this tax relief – HMRC has specific rules about who qualifies. In 2026, the rules are stricter than they were during the pandemic period. You can claim if you are an employee who has to work from home and you incur costs because of it.

According to HMRC, you can claim if:

-

Your job requires you to live far away from the office.

Perhaps your role is location-flexible but you were hired specifically to cover a region far from your company’s office, making a daily commute unreasonable. In such cases, your home is effectively your workplace by necessity. -

Your employer does not have an office (or no suitable workspace for you).

Some companies are fully remote with no physical office, or you might be a field-based employee with no desk at a company site. If there’s no office for you, then working at home is not by choice – it’s the only option. -

There are no appropriate facilities for your role at the office.

For example, if your employer’s office is too small or lacks a suitable workstation, and thus requires you to work remotely.

Crucially, you cannot claim this relief if working from home is optional or just convenient for you. HMRC explicitly states that you cannot claim tax relief if you choose to work from home.

This includes scenarios like:

- Your employment contract allows you to work from home some or all of the time, but doesn’t require it. If you have a hybrid work arrangement by agreement (and you could work in the office), then any home working is essentially by choice and not eligible.

- You work from home occasionally for personal reasons, or because you prefer to. For example, if your employer has a desk for you at the office but you decide to stay home a few days a week for convenience, you cannot claim relief for those days.

- Even cases like “the office is full, so you can’t go in sometimes” are not considered eligible by HMRC. In other words, if technically an office exists and it’s your choice or circumstance (not a contractual requirement) keeping you home, HMRC views that as non-qualifying.

Evidence of requirement:

Starting from the 2022–2023 tax year, HMRC tightened the rules to require proof that you had to work from home in order to grant the relief. This means that when you claim, you should be prepared to provide evidence such as:

- A note or email from your employer or a clause in your contract stating that your home is your workplace or that you must work remotely.

- Any other formal indication that you were required to work from home (e.g. company-wide announcement of office closure, if applicable).

If you cannot demonstrate that it was necessary for you to work from home, your claim may be denied under the current rules. During the height of COVID-19, this was relaxed (anyone forced home by government guidance could claim), but those days are over. As of 2026, only those with a clear work-at-home requirement should claim.

Note: This guide (and HMRC’s relief) applies to employees. If you are self-employed, you do not claim this employee tax relief for working from home. Instead, self-employed people account for home working costs in their business accounts or via their Self Assessment tax return (using actual expenses or a flat rate simplified expense method). (We have a specific Q&A on this in the FAQ section below.)

How to Claim Tax Relief for Working from Home

If you’ve determined that you’re eligible, the next step is to claim your tax relief. You don’t get this relief automatically – you have to apply for it, but it’s a relatively simple process:

-

Via Self Assessment (tax return):

If you already file a Self Assessment tax return each year (for example, if you have other income or are required to for any reason), you should claim your work-from-home expenses on your tax return. There is a section for employment expenses where this can be included. You would enter the amount (either £6/week for the appropriate number of weeks, or the actual amount of extra costs you’re claiming). The relief will then be factored into your tax calculation for the year. -

Via HMRC’s online portal (for non-Self-Assessment employees):

If you don’t file a tax return, HMRC provides an online service to claim tax relief for job expenses, including working from homefreshbooks.com. You can access this through the government’s website using your Government Gateway account. The online form will ask a few questions to confirm your eligibility (for example, it will remind you that you must not be choosing to work from home, etc., as different years have different criteria)hoa.org.uk. Once you pass the eligibility check, you’ll fill in details of your claim.

To use the online system, you will log in with or create a Government Gateway ID, then provide information such as the date you started working from home and the amount you’re claiming. (For instance, if you started working from home at the beginning of the tax year and are using the flat rate, you might claim £6 for each week up to the current date or end of year.) The system covers claims for the current tax year and can also handle backdated claims for previous years in one go hoa.org.uk. -

Form P87 by post:

Alternatively, you can submit a postal claim using Form P87 for tax relief on employment expensesfreshbooks.com. This is generally only necessary if you can’t use the online service. For example, if you need to claim for multiple jobs or your claim is for more than £2,500 of expenses in a year, the online system might not accept itfreshbooks.com. In such cases, a paper P87 form (or an online P87 through your Personal Tax Account) can be used. On the P87, you would list your home working expenses along with any other job expenses.

Current year vs. back years:

If you’re claiming for the current tax year, HMRC will usually adjust your tax code to give you the relief. In practice, this means your tax code will change to reflect a higher personal allowance (the amount of income you can earn tax-free) by the value of the expenses. You’ll then pay slightly less tax each pay period going forward. For example, after your claim is processed, you might see an increase in your tax code and a note in your payslip that your code includes a “work from home allowance”. This adjustment ensures you get your tax relief through reduced PAYE tax, rather than waiting for a rebate.

If you’re making a claim for earlier years (you can go back up to four years), HMRC will typically send you a refund for those years’ tax overpayments or adjust your tax code accordinglyfreshbooks.com. Often, they issue a tax rebate (cheque or bank transfer) for past years once the claim is approved, since you’ve already paid the tax in those years and are due money back.

Important:

Once you’ve made a claim (either via Self Assessment or the online portal), HMRC will process it and confirm the adjustment. If in the future your situation changes – for example, you stop working from home – you should update or cancel the claim. Otherwise, you might end up underpaying tax and owe money later because HMRC would continue giving you relief you’re no longer eligible for. In summary: claim when eligible, and inform HMRC if you cease to be eligible.

Changes Since the Pandemic

The rules for working-from-home tax relief saw significant temporary changes during the COVID-19 pandemic, and it’s important to understand what’s different now in 2023–2026 compared to those earlier years.

-

2020–2022 (Pandemic Eased Rules):

With millions suddenly required to work from home by government mandate, HMRC introduced a generous easement. In the 2020–21 and 2021–22 tax years, any employee who had to work from home for even one day because of the pandemic could claim the full annual relief (worth up to ~£140 for the year). HMRC did not require proof of regular home working in those years. Essentially, if you worked from home at any point due to COVID restrictions or employer closure of offices, you were eligible to claim £6/week for the entire year. This was an unprecedented relaxation of the normal rules and led to a huge number of claims. Basic-rate taxpayers could get about £62 back per year, higher-rate about £124 (per year) for those years. -

2022–2023 (Transitional Year):

By the 2022–23 tax year, COVID restrictions had lifted, and HMRC tightened the policy. They explicitly stated that you can’t claim if you choose to work from home (no more pandemic leniency)hoa.org.uk. They reintroduced the requirement that your situation must necessitate home working (not just convenience). HMRC also required employees claiming for 2022–23 and onwards to provide evidence of this requirement. However, they still allowed those who qualified to claim for the full week or even the full year as applicable. (In fact, HMRC confirmed that the special rule of claiming a whole year for any amount of home working would end after 5 April 2023, but remained in effect for the 2022/23 yearcipp.org.uk. This meant if you were eligible at any point in 22/23, you could claim the whole year’s relief – though far fewer people were eligible by then since most were back in office.) -

2023–2026 (Post-Pandemic Normal Rules):

Now, in the 2023/24 tax year and looking ahead to 2025/26, the rules have fully reverted to the stricter criteria that existed pre-COVID. You can only claim if you genuinely have to work from home (as detailed in the “Who Can Claim” section) and you have additional costs. If you’re hybrid or working from home by choice, you’re not eligible. The temporary pandemic concession is gone. So, many people who claimed in 2020-2022 will find they cannot claim this relief anymore unless their work arrangements formally require home working. It’s important to be aware of this change to avoid incorrect claims. HMRC’s eligibility checker now asks questions to filter out voluntary home workers, and they warn that making a false claim could lead to penalties.

Can you still claim for the lockdown years now?

Yes, if you never claimed your tax relief for the 2020/21 or 2021/22 tax years, you can still submit backdated claims as long as the deadlines have not passed. As of early 2026, you may still claim for the 2021/22 tax year until 5 April 2026. You can also claim for 2022/23 until April 2027, and the pattern continues for later years.

The deadline for the 2020/21 tax year was 5 April 2025. If you missed that date, you are unfortunately too late to claim for that specific year.

For any eligible tax year still within the four-year window, you can make your claim retroactively through the online HMRC portal or by using a Self Assessment tax return. Many people submitted these claims during 2020–2022, but if you were unaware at the time, you might still be able to receive the relief now, provided you met the qualifying criteria for those years.

Record-Keeping Requirements

-

Proof of Requirement:

As noted, for recent claims you should keep evidence that you were required to work from home. This could be a copy of your employment contract (if it states your work location or home-working requirement) or a letter/email from your employer. When you make the claim through HMRC, you may need to provide or at least attest to this evidence. It’s wise to keep this documentation in your personal files in case HMRC asks for it later. -

Receipts and Bills (for actual cost claims):

If you decide to claim more than the flat rate (i.e. you’re claiming actual expenses), you must keep detailed records of those expenses. Save your utility bills, phone bills, etc., and maintain a calculation of how you arrived at the work-related portion. For example, you might keep a spreadsheet of your monthly electricity usage, the percentage of the home used as an office, and the time spent working, to justify the portion claimed. You would also retain receipts for any itemized costs (like a work phone line installation or a dedicated piece of equipment with no personal use). HMRC can request these records to substantiate your claim, especially if the amount is significant. -

Flat Rate Claims (no receipts required):

If you only ever claim the flat £6/week, HMRC does not need utility receipts from you. The flat rate is an allowance that doesn’t require proof of spending (because it’s considered a reasonable standard amount). However, you should still keep proof that you were eligible (again, evidence that you had to work from home). Also note, even though you don’t submit receipts for the £6/week, you cannot claim it for weeks you weren’t actually incurring costs due to home working. So if your work-at-home requirement ended mid-year, you shouldn’t claim the allowance beyond that point. -

Duration of Records:

Keep your records for at least 22 months after the end of the tax year if you’re an employee (or longer, generally 5 years, if you filed a Self Assessment). For example, for a claim in the 2025/26 tax year, keep your documentation until at least April 2028. This is standard HMRC record-keeping practice in case of any review or audit. -

Logs of usage:

It may help to keep a simple log of your working-from-home days or hours, especially if it’s not every day. This isn’t strictly required to file a claim, but it can support your calculation of actual costs. For instance, if you claim 30% of your heating bill was for work, you should have a basis for that figure (maybe you worked from home 30% of the time). A work diary or schedule can serve as evidence of how often you were at home for work, if ever needed.

Tax Relief Calculation Examples

It’s helpful to understand how much tax relief you actually get from these claims. Remember, claiming £6 per week doesn’t mean you get £6 cash back – you get the tax on £6 back. Here are some examples:

-

Flat Rate, Basic-Rate Taxpayer:

Suppose you claim the flat £6 per week for the whole year, and you pay the basic 20% income tax rate. HMRC will give you relief on £6/week, which equates to £1.20 off your tax per week. Over a full 52-week tax year, that totals around £62.40 in tax relief for the year. In other words, you save £62 (this is the 20% of approximately £312 of expenses that year). You’re not getting hundreds of pounds back, but ~£62 is the annual tax saving – essentially, your take-home pay ends up about £62 higher than it would have been. -

Flat Rate, Basic-Rate Taxpayer:

If you pay the 40% tax rate, £6 a week in expenses yields £2.40 per week in tax reliefhoa.org.uk. Over a year, that’s about £124.80 in tax relief for a higher-rate taxpayerhoa.org.uk. Higher earners get more back because they would have paid more tax on that £6 – so reclaiming it saves them 40% of £6 instead of 20%. -

Actual Costs Example:

Let’s say you calculated that your extra household costs from working from home are £10 per week (perhaps you work long hours with power-hungry equipment). If you’re a basic-rate taxpayer, you could claim tax relief on £10/week. HMRC would then refund you 20% of £10 = £2 each week. If this was for a whole year, that’s roughly £104 for the year. A higher-rate taxpayer in the same scenario would get £4/week back, roughly £208 for the year. However, claiming above £6/week means you’d need to have the evidence to justify that £10/week cost – it’s perfectly allowed, just subject to verification. -

Partial-year Example:

Imagine you started a new job in July 2025 which required you to work from home, and you claim the flat rate from that point. There are 39 weeks from the start of July 2025 to April 5, 2026 (approximately). As a basic-rate payer, you’d get 39 × £1.20 = £46.80 in relief for that part-year. The claim is proportional to the time you were incurring costs at home. (If this was during the pandemic years and you met the criteria for any part of the year, you would have been allowed the full year’s £62 – but currently it’s effectively pro-rata based on the weeks you actually qualify.)

These examples show that while the tax relief is not huge, it’s still worthwhile to claim if you’re eligible – after all, it’s money you’re entitled to that would otherwise stay in the taxman’s pocket.

Tip: If your employer offers to directly pay you a home-working allowance of £6/week, that’s equivalent to the tax relief for a basic-rate payer (either way you end up ~£6 better off per week pre-tax). But if they don’t, then claiming this relief ensures you get something back for those extra cups of tea and heating your home office!

Common Mistakes to Avoid

When dealing with taxes, it’s easy to get tripped up by the details. Here are some common mistakes people make with the work-from-home tax relief – and how to avoid them:

-

Claiming When You’re Not Eligible:

This is the number one pitfall. Some people heard about the generous pandemic rules and assume they can still claim even if they choose to work at home. Don’t claim the relief if your home working is voluntary or not a necessity – HMRC has made it clear that choosing to work from home doesn’t qualify. If you put in a claim despite not meeting the criteria, you’re effectively making a false claim. HMRC can claw back the tax relief, and in cases of deliberate false claims, you could even face penalties or prosecutiont. Always be honest about your situation in the eligibility checker and on the form. -

Overestimating Broadband or Dual-use Expenses:

A frequent mistake is trying to claim for expenses that are partly personal. For example, claiming your full broadband bill as a work expense is usually incorrect if others in your household use it or you use it off the clock. HMRC specifically disallows claims for broadband or other costs that are not solely for work. If you didn’t incur an extra charge for internet because of work (say, you already had unlimited broadband anyway), then you really shouldn’t claim any broadband costs. At most, you might claim the cost of any work-specific calls or a work-only data package. Be conservative and factual with such expenses – claim only the portion that relates to work and that you can evidence. Over-claiming can lead to HMRC rejecting your claim or reducing it after review. -

Not Keeping Evidence for Larger Claims:

If you stick to the £6/week, you generally won’t need to show receipts. But if you decide to claim a higher amount, don’t neglect the paperwork. A mistake some make is to estimate a high figure (like “I think I spent £15 a week extra”) without actually being able to back it up. Later, if HMRC asks for proof, they might find your claim unsubstantiated. To avoid this, keep those receipts, bills, and calculation notes for any claim above the flat rate. Even for the flat rate, have your employer’s confirmation of required home working saved. Essentially, be ready to support your claim. If you can’t, either adjust the claim to £6/week or wait until you have the documents. It’s better to claim a sure £6/week than to claim £10 and be unable to prove it, which could result in no relief at all. -

Forgetting to Update HMRC if Circumstances Change:

(Related to claiming when not eligible, but worth noting.) If you claimed the relief and later your situation changes – say you return to office-based work – don’t forget that the relief should stop. HMRC may continue your tax code adjustment into the next year if you don’t inform them, which could lead to a tax underpayment. Many people aren’t aware of this until they get a surprise tax bill. Avoid this by informing HMRC (you can do so online or by phone) if you stop working from home, so they remove the allowance from your tax code going forwardfreshbooks.com. This will save you from a potential headache at year-end.

By steering clear of these mistakes, you can ensure your claim is smooth and accurate. When in doubt, consult official HMRC guidance or seek advice from a tax professional, especially if your situation isn’t straightforward.

Summary & Advice

Claiming tax relief for working from home can be a simple way to recoup some of your extra home expenses, as long as you meet the eligibility conditions.

The key takeaways from this guide are:

-

Eligibility matters:

In 2025–2026, you generally must be required to work from home by your job situation to claim this relief. Optional or hybrid arrangements (where you have a choice) typically don’t qualify. Always start by assessing if you truly meet HMRC’s criteria under current rules. -

Know what you can claim:

Focus on the additional costs like heating, electricity, and work phone calls that you have because you’re working at home. Use the flat £6/week rate for simplicity in most cases. Remember, you can’t claim broad, non-work expenses (rent, normal bills, etc.), and you shouldn’t inflate claims for things that also have personal use. -

Flat rate vs actual costs:

For most people, the flat £6/week (about £62 of tax relief a year at basic rate) is the easiest and sufficient method. If you believe your work-related costs are much higher, you can claim more, but be prepared with documentation. It might be worth speaking to a tax advisor if you plan to claim a significantly higher amount. -

How to claim:

Use your Self Assessment return or the HMRC online portal to put in your claim. It’s not automatic – you do need to apply, but it’s a quick process that can often be done in minutes if you have a Government Gateway account. For past years, make sure to claim before the deadlines (within four years of the tax year). -

Keep records:

Maintain proof of your home working requirement and any receipts if claiming actual costs. Good records ensure you can substantiate your claim if asked. -

Don’t leave money on the table (if eligible):

If you are eligible and haven’t claimed yet, do take action. Many people are still unaware they can claim for previous years. It might not be a huge sum, but it’s your money – for example, two years of claims for a basic-rate payer could be about £124, which is certainly better in your pocket than with the Treasury. -

Ask for help if needed:

If you’re unsure about any aspect or your situation is unusual, consider reaching out to an accountant or a tax adviser. They can provide personalised guidance. This is especially useful if you have other tax considerations or if you want to ensure you’re claiming correctly. The cost of advice might be worth it to avoid mistakes or missed claims.

In conclusion, work-from-home tax relief in the UK is a nice perk for those who qualify, helping offset the costs of your home doubling as your office. The rules now are more strict than during 2020–2022, so make sure you follow the current guidelines. By doing so, you’ll confidently claim what you’re due and avoid any issues. If you’re ever in doubt, refer to HMRC’s official guidance or seek professional advice. Happy (and tax-efficient) home working!

FAQ - Work from Home Tax Relief in 2026

What can I claim for working from home?

You can claim tax relief on additional household expenses that arise because you work from home. This typically includes the extra cost of heating and lighting your workspace, work-related electricity usage, business phone calls, and a portion of your broadband/internet if it’s required solely for your work. The expense must be incurred wholly, exclusively, and necessarily for your job dutiescipp.org.uk. In practice, many employees use the flat £6 per week allowance to cover these costs. Keep in mind you cannot claim for general home costs like rent, mortgage, or bills that you would pay anyway, nor for any expense that is partly for personal use (e.g. your normal broadband service that your whole family uses).

Can I still claim tax relief for 2020?

If by “2020” you mean the 2020/21 tax year (April 2020 – April 2021), the deadline to claim work-from-home tax relief for that year was 5 April 2025. Unfortunately, this deadline has passed, which means you can no longer submit a new claim for the 2020/21 tax year.

However, you can still claim for later years. As of 2026, you may still submit a claim for the 2021/22 tax year if you have not already done so and you met the eligibility criteria during that period. The deadline for 2021/22 is 5 April 2026.

Remember that you can claim tax relief for the current tax year and up to the four previous tax years. Each tax year is processed separately, but the online HMRC portal allows you to submit backdated claims in one session.

So although the earliest lockdown year is now closed for claims, it is important not to miss the remaining deadlines for any year in which you were entitled to relief.

What if I work hybrid (part office, part home)?

Hybrid working on its own doesn’t guarantee you tax relief – it depends on why you’re working from home. If your hybrid arrangement is by choice or mutual agreement (meaning your employer provides an office space but allows you to work from home some days), then no, you generally cannot claim the tax relief for those home days. HMRC’s rule is that you can’t claim if you choose to work from home, even if it’s just for part of the week.

However, if your hybrid schedule is structured because the employer requires it, the situation becomes more complicated. This includes cases where the employer mandates specific days working from home due to office space limits or rota systems.

HMRC’s guidance suggests that if an office exists and you still have the option to be there, the home-working days may be treated as a choice. This applies even when access to the office depends on a rota or limited capacity.

HMRC also states that if your employer has an office but you cannot go in because it is full on some days, this is still viewed as you choosing to work from home. As a result, most hybrid workers who have a desk available at least some of the time will not qualify for the relief under the current rules.

If you are unsure, it is best to use HMRC’s online eligibility checker. It provides a simple way to confirm whether your working pattern meets the official criteria.

If you do qualify — for example, when no office space is available for you on certain days as part of an employer’s planned structure — you can claim the relief only for the weeks you were required to work from home. This situation is uncommon, because modern hybrid working is generally considered voluntary or flexible rather than mandatory.

Can I claim if I’m self-employed?

If you’re self-employed, you do not claim the employee work-from-home tax relief that we’ve been discussing. That relief is only for employees on PAYE who are working from home. Instead, self-employed people can deduct home office expenses as part of their business expenses on their Self Assessment tax return. There are two ways to do this:

- Actual expenses method: You calculate the portion of your home costs (utilities, rent, etc.) that relate to your business work and deduct those in your accounts.

- Simplified expenses method: This is a flat rate system HMRC offers for small businesses working from home. For example, if you work at home 101 hours or more in a month, you can claim a flat £26 per month as a business expense (the rate is lower for fewer hours). This is instead of tracking exact bills.

So, while you can’t use the £6/week employee scheme, you have your own method to get relief on home-working costs through your tax return. The concept is similar (offsetting household costs due to work), but the process is different. If you’re unsure how to calculate this, consult an accountant – but do not fill in the employee claim form if you are self-employed, as that could complicate things.

How do I provide evidence to HMRC for my claim?

When you apply for the working-from-home tax relief, HMRC may ask for evidence of eligibility, especially for recent years. First, you’ll need to show that your employer required you to work from home (for claims in 2022/23 onwards). This evidence could be:

- A clause in your employment contract stating your place of work is home, or you must work remotely.

- An official communication (email or letter) from your employer that instructs you to work from home, or confirms there were no available facilities at the office, etc.

- Any similar document that proves it wasn’t your personal choice.

Second, if you are claiming more than the flat £6/week (i.e., claiming exact amounts), you need to provide proof of the expenses themselves on gov.uk.

This means copies of bills, receipts, or invoices for the costs you incurred. For example, copies of your electricity bills showing the amounts, phone bills highlighting work call charges, or receipts for a dedicated work broadband line.

When using the online claim portal, you will be guided to indicate if you’re claiming £6/week or actual costs. If you choose actual costs, be prepared to submit or at least have the figures from your bills available.

HMRC might not ask for all the paperwork upfront, but they reserve the right to inquire further.

If you’re filing via Self Assessment, keep the evidence in your records because HMRC could ask you to supply it if they check your return.

How much tax relief will I get?

The tax relief you get is based on the amount of eligible expenses and your tax rate. For the standard flat rate of £6 per week, a basic-rate (20%) taxpayer will get back £1.20 per week in tax relief. That equals roughly £62 over a full year (52 weeks) of working from homehoa.org.uk. A higher-rate (40%) taxpayer would get £2.40 per week, which is about £125 for the yearhoa.org.uk. These figures represent the reduction in tax, not a direct cash payment of £6 – essentially, you save that amount of tax.

If you claim actual costs and they are higher than £6/week, you will get 20% (or 40% if you’re a higher-rate payer) of whatever amount you claim. For example, if you prove £10 a week of additional costs, a basic-rate payer gets £2/week back (which is 20% of £10).

It’s worth noting that for most people the flat rate covers a lot of the typical cost, and the tax relief is modest (tens of pounds over the year). But it’s still better to claim it than not. Also, if your employer already pays you £6/week extra in your wages for home working, then you’re effectively receiving the same benefit (basic-rate taxpayers would be £1.20 better off per week post-tax from that; higher-rate £2.40) and you wouldn’t claim from HMRC on top of that.

Do I need receipts to claim working from home tax relief?

If you are claiming the flat £6 per week (the simplified method), you do not need to submit receipts or bills to HMRC for those expensesfreshbooks.com. HMRC doesn’t ask for proof of how you spent that £6/week – it’s a flat allowance. However, from 2022 onwards, you do need to have proof that you were required to work from home (like employer’s confirmation) even for the flat rate claim. So while you don’t show utility bills, you should have something that shows you qualify.

If you are claiming actual expenses above £6/week, then yes, you’ll need receipts and records. Any claim for the exact amount spent requires evidence such as utility bills, phone bills, or receipts for purchases, as well as a calculation of the work-related portion if it’s not obviousgov.uk. You don’t necessarily send all these receipts with an online claim, but you must have them available. HMRC can request this evidence if they review your claim. So, in summary: no receipts needed for flat £6 claims, but keep relevant documents for any higher claims (and you’ll certainly need to provide those figures when filling the forms).

Can I claim for previous years if I didn’t know about this?

Yes. HMRC allows you to backdate claims for up to 4 tax years prior to the current one. That means in the 2025/26 tax year, you could still claim for the 2021/22, 2022/23, 2023/24, and of course 2024/25 (if not already claimed). Each older tax year has a deadline – it’s the fifth April that is four years after the end of that tax year. For example, for the 2021/2022 tax year (which ended 5 April 2022), the claim deadline is 5 April 2026freshbooks.com. For 2022/2023, you have until April 2027, and so on.

You can claim for multiple years in one go. The online portal will ask which years you want to claim for. You’ll need to confirm your work-from-home status for each year (note: the eligibility rules differed in 2020–22 vs later, and the portal accounts for that). If approved, HMRC will either adjust your tax code to give you the relief for those years (if it’s relatively recent and you’re still employed) or more commonly, they’ll send you a refund for the past years. Refunds might come as a cheque or bank deposit representing the tax you’re getting back for those years.

So, if you missed out on claiming earlier, it’s not too late as long as you’re within that four-year window. It’s a good idea to do this sooner rather than later so you don’t accidentally miss a deadline.

What if my employer already gives me money for home working?

If your employer is already covering your home-working costs (for example, paying you an extra allowance or reimbursing your bills), then you cannot claim tax relief on those same expensesfreshbooks.com. HMRC will not give you relief for something that didn’t ultimately cost you out-of-pocket.

One common scenario is an employer paying the HMRC-recommended £6 per week tax-free to employees who work from home. If you receive that through your payroll, you’re effectively getting the benefit (your employer is giving you the equivalent amount that HMRC’s tax relief would have provided). Therefore, you shouldn’t claim an additional tax relief on top of it – doing so would be double counting.

Another scenario: if your employer reimburses a specific bill (say they pay your internet bill), you cannot claim tax relief on that internet cost as well. You can only claim for unreimbursed expenses. In short, you either get the tax-free allowance via your employer or claim tax relief from HMRC – not both. If your employer only covers part of the costs, you could potentially claim the tax relief on the portion you paid yourself, but be sure to clarify that in the claim.

Do I have to apply for this every year?

Not necessarily. If you apply for the tax relief and it’s granted, HMRC often adjusts your tax code going forward to include the work-from-home allowancefreshbooks.com. This means they assume you will continue to qualify in the next year, and you’ll keep getting the tax break without applying again each year. For example, if you claimed for 2025/26, your 2026/27 tax code might automatically carry on the allowance. However, you should review this each year because if your situation changes (say you stop working from home), HMRC won’t know that unless you tell them.

If you continue working from home under the same conditions, you don’t need to do a new claim every April – the adjustment should roll over. But do check your new tax code letter each year to ensure it reflects your situation. If you see an allowance and you no longer qualify, contact HMRC to remove it to avoid a future bill. Conversely, if you didn’t have it and you should, you may need to apply or reapply.

One exception: if you initially claimed via Self Assessment on a tax return, you’d need to include it in each year’s return (as tax returns cover one year at a time). There’s no automatic carry-forward in the Self Assessment process – you just claim it anew on each return, which is straightforward if your situation hasn’t changed (just remember to do so).

In summary, the PAYE tax code route typically renews automatically, but always inform HMRC of changes. It’s your responsibility to keep your tax code accurate, but you don’t need to needlessly reapply each year if nothing changes.